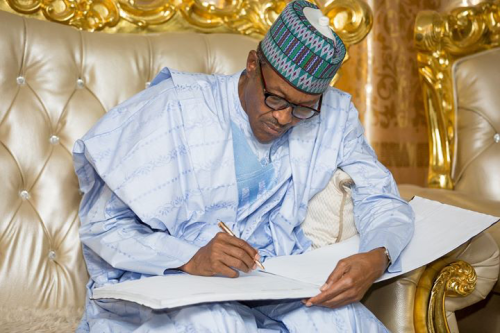

-President Muhammadu Buhari (PMB) will on Tuesday officially launch N20billion ‘Anchor Borrowers’ Programme’ (ABP) which the Central Bank of Nigeria has set aside for rice farmers across the country.

The programme which is an initiative of the Central Bank of Nigeria (CBN) aimed at creating an Ecosystem to link out-growers (Small Holder Farmers) to local processors will take place in Kebbi State.

Under the ABP, the CBN in a statement Saturday said it has set aside the sum of N20 billion from the N220 billion Micro, Small and Medium Enterprises Development Fund (MSMEDF) for farmers at a single-digit interest rate of 9.0 per cent to address the challenges of poor funding.

The Governor of the CBN, Mr Godwin Emefiele who met with rice producers and millers recently, said that the developmental initiatives programme has been designed to create economic linkages between farmers and processors to not only ensure increased agricultural output of rice paddy, but also importantly close the gap between production and consumption by ramping up utilisation capacity of Nigeria’s integrated rice mills.

Emefiele said If these noble objectives can be achieved, it is not unlikely that the country will require even more integrated milling capacity to meet the huge local production of rice paddy.

According to him, “The essence of the meeting was not to apportion blames to any party on the current prevailing situation but to identify ways for all stakeholders to work together in a creative synergy to mop up any excess unsold paddy and going forward key into the CBN’s ‘ABP.

Emefiele who expressed optimism that the new initiative would work, urged millers and investors in the rice value chain who have been joined by representatives of the state governments of some key rice producing states to collaborate with the CBN to ensure that in the next few years Nigeria as a great country will no longer be one of the world’s highest importer of rice but a net exporter of the commodity.

He, however, said that the country can never fully attain its true potentials by simply importing everything into the country, stressing that such trend has resulted in the low operating capacities of the manufacturing industries and cannot be allowed to continue.

He explained that policy document of the programme also indicated that the anchor borrowers’ programme will build capacity of banks in agricultural lending to farmers and entrepreneurs in the value chain, reduce commodity importation. It will also reduce the level of poverty among small holder farmers and create jobs while assisting rural small-holder farmers to grow from subsistence to commercial production levels.

He identified lack of mechanisation, low quality inputs and poor funding as major hindrances to rice production in Nigeria but stressed that the programme was aimed at solving the problem of finance.

On the conditions for accessing the loan, the CBN boss said the farmers will be thoroughly trained on the global best agronomical practices.

“The farmers must be a member of a validated cooperative before applying for the loan. We will find out how much it will take to produce one hectare of rice to determine the amount that will be given to each individual. The idea is to enhance efficient management of the resources” he said.

Speaking further, he said Nigeria is a major rice producer with over 20 key rice producing states in the country with most cultivating under two seasons: wet and dry seasons.

“Rice is one crop in which the country has comparative advantage to easily become self-sufficient given the huge potentials that exists. Today, rice is no longer considered a luxury food to millions of Nigerians but has become a cereal that constitutes a major source of calories for both the rural and urban populations of the country.”

“Indeed figures from the Federal Ministry of Agriculture and Rural Development indicate that in the period, 2012 to 2014 paddy rice production in the country grew from 4.5 million metric tones in 2012, to 7.89 million metric tones in 2013, peaking at 10.7 million MT in 2014.”

The Governor said that the capacity of the country to achieve even better production figures cannot be overemphasized, considering that only about 40 per cent of the available potential land area for rice production is currently being cultivated.

He stated that the production figures above show that in recent history, the country had never witnessed such rapid growth of paddy rice production.

Meanwhile, some dynamic features of this new agricultural initiative include the Identification and selection of Small Holder Farmers, grouping of out-growers into viable cooperatives/clusters, registration of the cooperatives, determination of the economics of selection and engagement of banks/ insurance companies, capacity Building of out-growers, banks’ staff and extension agents.

Other salient features of the initiative also include opening of bank accounts by cooperatives/farmers, loan application and disbursement, commencement of agronomic practices and distribution of agro-inputs at recommended periods.